By Alex Milstein – [email protected] – Contributor

Illegal marijuana grown in North Carolina legally requires tax stamps, and failure to affix the stamps leads to additional civil charges.

“North Carolina enacted an original tax stamp law, a pretty aggressive tax that was very high in proportion to the value of the drugs,” said Rod Kight, owner of Kight Law Offices in Asheville. “It also had a lot of penalties and little things built in. That tax law was ruled – unconstitutional may not be the right word – but it was stricken by the Fourth Circuit Court of Appeals on the basis that it actually constituted a criminal penalty rather than just a revenue based penalty for the state of North Carolina.”

Kight said the Lynn v. West case, though it could not prove the stamps completely unconstitutional, changed the rules of tax stamps.

“What happened was, there was an individual found guilty of a drug charge, and then was ordered to pay the tax based on the tax stamps. Lynn argued that having to pay the tax was considered double jeopardy and that he was not afforded the protections of the criminal law, and the Fourth Circuit agreed with him,” Kight said.

Kight said the present incarnation of the tax stamp law passed the challenge of the Lynn case but still shows flaws.

“Several different courts have found it to be a proper exercise of the revenue generating function of the state and it’s not a criminal penalty. So the way it works is: if you buy illegal drugs, it has to have a tax stamp. You have to affix the stamp to the illegal drug so that you’re paying the proper tax. It’s doesn’t mean that the drugs are legal to have, it just means that you’re legally paying taxes on them.”

Kight said a disconnect exists between something being illegal or legal to posses and then taxation of the substance.

Failing to affix uncontrolled substances tax stamps to illegal taxable products, such as illicit spirituous liquor or controlled substances, results in a 140 percent fine of the tax plus interest. For marijuana, the N.C. Department of Revenue charges 40 cents per gram for stems and $3.50 per gram if the owner possesses 42.5 grams or more.

Trevor Johnson, director of public affairs for the N.C. Department of Revenue, said the process of finding people who use tax stamps on an illegal product starts when a local law enforcement agency discovers an individual in possession of a taxable quantity of controlled substance without the appropriate tax stamps affixed.

Johnson said the Department of Revenue requires the law enforcement agency to submit a BD-4 form, which provides information about the taxpayer and the amount and type of controlled substances in possession.

“The Department of Revenue issues a tax assessment to the taxpayer based upon the quantity of controlled substance possessed and then demands payment,” Johnson said. “If the taxpayer pays the assessment, the tax matter is resolved. If the taxpayer does not pay the assessment, the department may utilize various civil collection tools to collect the tax due.”

Johnson said state law requires this tax law on marijuana, but nothing about it will protect citizens from criminal charges.

“Article 2D, G.S. 105-113.105 states the purpose of this article is to levy an excise tax to generate revenue for state and local law enforcement agencies and for the General Fund. Nothing in this Article may in any manner provide immunity from criminal prosecution for a person who possesses an illegal substance,” Johnson said.

Johnson said the fact that N.C. deems marijuana illegal is irrelevant for tax purposes.

“The unauthorized substances tax is an excise tax. An excise tax is a tax on the purchase, use or consumption of certain products. There are excise taxes on motor fuels and other products such as tobacco.”

The law considers telling authorities about a person who purchases tax stamps for an illegal product as a Class 1 misdemeanor.

“The stamp purchaser is not required to provide their name or other identifying information when purchasing marijuana stamps,” Johnson said. “Employees of the Department of Revenue are required by law to issue stamps to the purchasing party, based upon the taxpayer’s completion of the return and payment of the tax.”

Todd Stimson, a Fletcher resident, paid taxes on his marijuana crop until police raided his home and halted his operation.

“How can the state be the victim when the state was accepting money for an illegal product?” Stimson said. “I’ve already gone through two lawyers, and I’m on my third lawyer now, because no one has ever seen a case like this before and they don’t know how to take it on.”

Stimson paid for legal licenses issued by the Department of Revenue in Raleigh and attached them to his product.

“I had to get rid of the first lawyer because he told me to shut up and not say anything to the public, but the public needs to know what’s going on. So I fired him, and the second lawyer wasn’t filing the papers correctly in regards to the civil aspects, where they are trying to say that I owe $24,000 in taxes, when here I had already paid my taxes and had tax stamps on my product. Well, my lawyer wasn’t saying that I filed my taxes correctly, so I had to fire him too. I’m on my third one and hopefully everything will work out now.”

John Elkins, a lieutenant with the Buncombe County Sheriff’s Office, said he knows a small amount about how tax stamps on illegal substances work from one prior case.

“It is issued, I believe, by the Department of Agriculture,” Elkins said. “They do not report that to any law enforcement database, that is solely for tax purposes. That really has nothing to do with the fact that possessing, growing or manufacturing marijuana is illegal.”

Elkins said if a person pays taxes on marijuana and gets caught, they only evaded the tax aspect of the crime, not the criminal charges.

Van Duncan, sheriff of Buncombe County, said he didn’t realize N.C. allowed the sale of tax stamps for growing marijuana.

“I can see a real problem with this,” Duncan said. “The DEA, when it comes to what they would consider this as, is trafficking marijuana, because the federal government still views this as a Schedule 1 drug. They still view marijuana as tremendously harmful and impactful, dangerous drug, in the same category as peyote and some hard other drugs. The states have the ability to decide on some issues that the federal government does not.”

Duncan said the legality of tax stamps for illegal substances strikes him as strange.

“A lot of the foundations based on the laws in the country, if it’s a legal thing it’s not necessarily prohibited. There’s an advocacy toward it, not whether it’s right or wrong, but if it’s legal or not. And if the states make the determination that these tax stamps are legal, I do see a ton of potential problems and issues. I’ve not heard from the DEA about how they are going to handle enforcement on North Carolina tax stamps in a state where it’s still illegal.”

According to Duncan, a large concern with being a law enforcement officer deals with looking at the big picture of crime in the county.

“We had 14 homicides in Buncombe County last year, we’re a county that normally has three to five on average. Every homicide that we had, except for one, in some way ties back to controlled substance abuse. Whether it was bath salts, heroin or copious amounts of marijuana that led to the other drugs, because we’ve had a long term history with some of the folks who were involved.”

Duncan said the need for a broader discussion around this issue approaches quickly and must involve legislatures, law enforcement and the general public.

Latest Stories

- What Do Blue Banner Staff Listen To?

- Asheville residents at odds over U.S. financial assistance to Ukraine

- The UNC Asheville Saber Club’s duels remain, moved to AC Reynolds Green

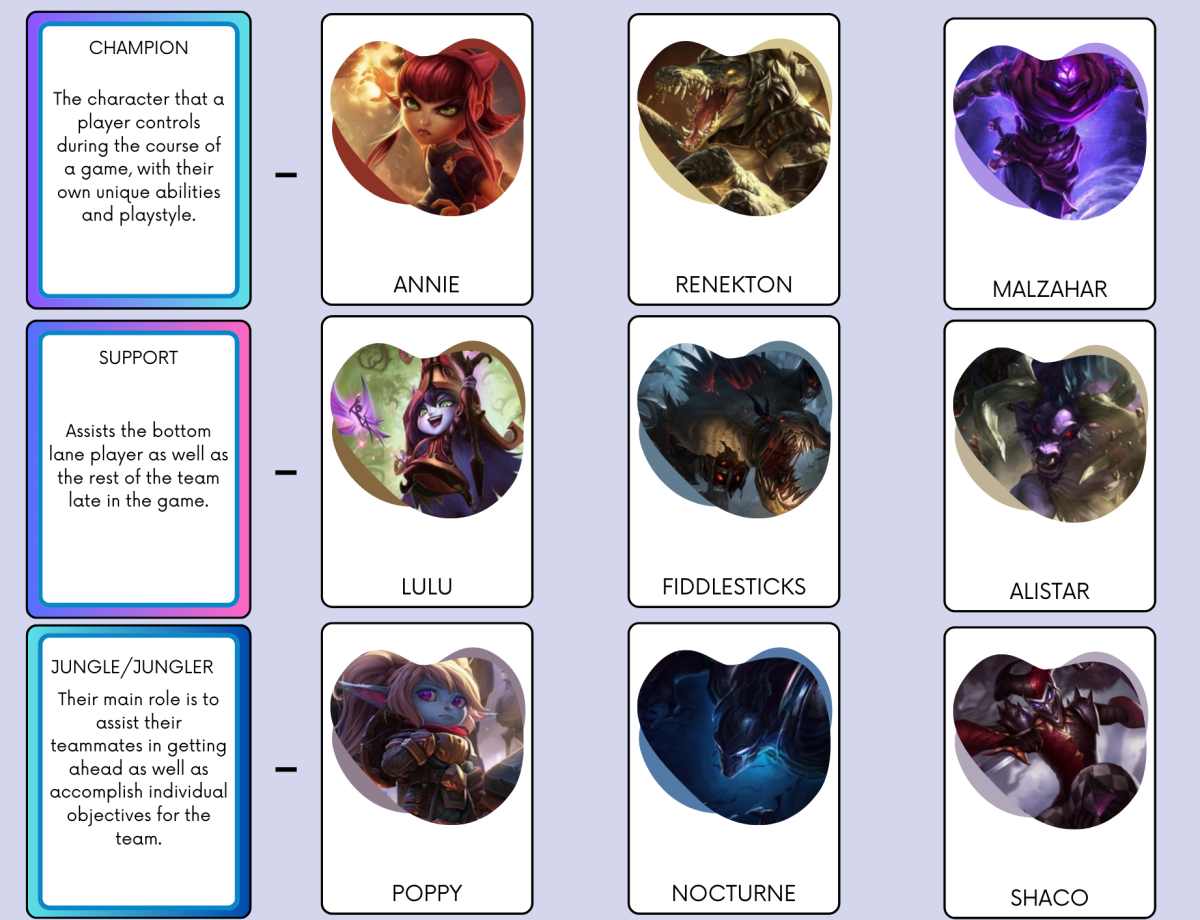

- UNCA League of Legends takes first in stunning finals match against HPU

- From passion to professional play: How a UNCA League of Legends MVP hit their stride

- Old UNCA sorority still has its footprints on campus

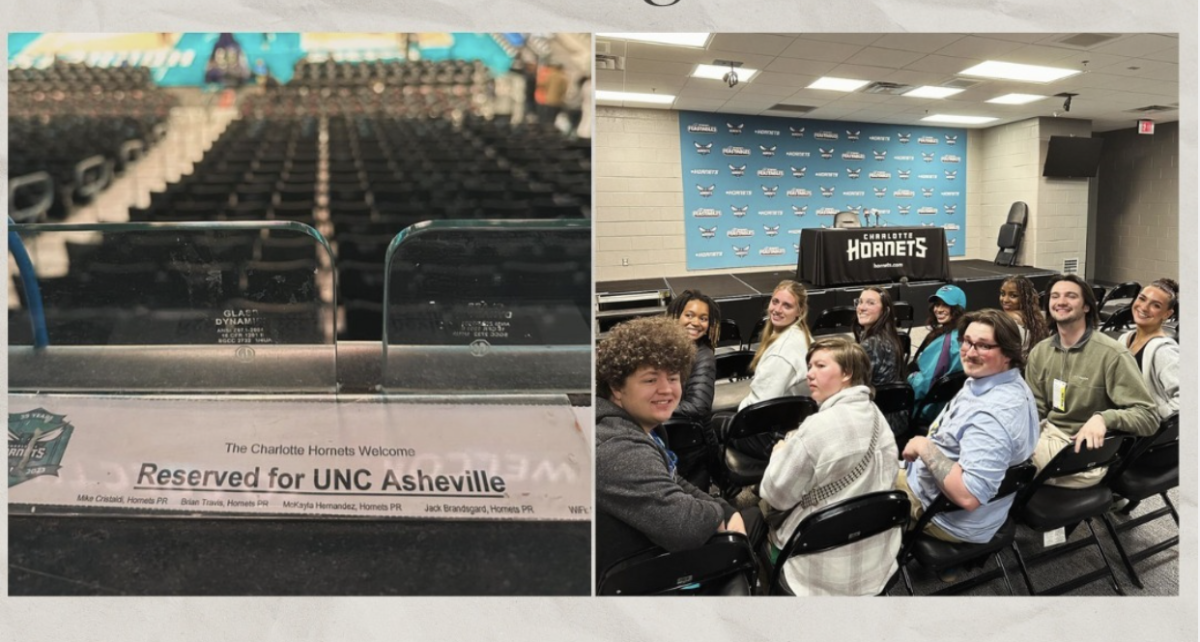

- Mass communication students visit Charlotte to watch Hornets game

- Blue Banner Connections #1

- Sex toys get luckier than traditionalist men

- A student's perspective on traveling and concerts

اغاني 2017 • Oct 12, 2017 at 1:24 am

What’s up,I read your blogs named “N.C. law requires marijuana grown in state to be taxed – The Blue Banner” on a regular basis.Your writing style is witty, keep doing what you’re doing! And you can look our website about اغاني 2017.