Millennials don’t spend money all that differently from past generations. They just have less of it.

Such is the finding of a recent study by economists at the Federal Reserve Board, which has been greeted as a rejoinder to the roughly 3,001 trend pieces published this decade about how young adult consumer habits are either changing the economy, or leading today’s twenty and thirtysomethings into a financial black hole. You know the stories. Millennials don’t like buying cars. We don’t save for retirement because we spend too much money eating out. We killed canned tuna and American cheese. The common theme running through many of these pieces is that millennials’ spending decisions aren’t driven merely by financial circumstances, but also changing tastes. We treasure avocados and walkable cities and prefer spending on data plans than car payments.

Not so, the Fed paper seemingly suggests. The researchers show that while millennials households are less wealthy and, by some measures, have lower incomes than previous cohorts, when it comes to spending and saving they aren’t all that unique.

This will undoubtedly be satisfying for every 32-year-old who is tired of being written about as a bizarre and fickle subspecies of American consumer. But reader, I have some bad news for you: This study does not, in fact, debunk every weird trend piece about young adult shoppers. It mostly debunks one I co-wrote six years ago. Let me explain.

Back in 2012, Derek Thompson and I published an article in the Atlantic titled “The Cheapest Generation.” (We didn’t pick the headline, but have been getting flack about it from aggrieved readers ever since.) At the time, data showed that homeownership had collapsed among the young, who were also shrinking as a share of new car buyers. Some of the reasons why were obvious: The Great Recession had left masses of young people unemployed or underpaid while college grads were staggering under unheard of student debt loads. But we also argued that, in the future, millennials might buy fewer, as not to mention smaller, houses and cars, for cultural and technological reasons. Young people liked urban, walkable neighborhoods, and the sharing economy made buying a ride less necessary (Zipcar featured prominently in the story, I shudder to tell you). There was a shift in the zeitgeist underway among our peers, we insisted, and that could have implications for the shape of the economy.

This is the hypothesis the Fed researchers set out to test with some academic rigor: that millennials actually want to live a lower-cost lifestyle. That they are, to put it a bit trollishly, cheap. Their answer is a pretty unequivocal no. (And yes, the “Cheapest Generation” does show up in their footnotes, listed among a number of similar works of journalism the paper basically sets out to steamroll). Using a variety of data sets, the paper compares millennials’ family finances and shopping budgets with those of Generation X and the baby boomers when they were roughly the same age. “We find little evidence that millennial households have tastes and preference for consumption that are lower than those of earlier generations, once the effects of age, income, and a wide range of demographic characteristics are taken into account,” they conclude. “This conclusion also holds for spending on automobiles, food, and housing.”

What the researchers do find is that millennials—who they define as Americans born between 1981 and 1997—are relatively broke. The average net worth—assets, minus debts—of a young adult household in 2016 was 20 percent less than baby boomer households in 1989 and 40 percent less than Gen X households in 2001. The deficit is driven in large part the by the fact that millennials are much less likely to own homes and much more likely to have student debt. (It’s also in keeping with another Federal Reserve study from this year showing that millennials are trailing far behind previous generations on wealth accumulation, even though they have comparable savings habits.) Income is a somewhat more complicated picture, but after controlling for age, education, demographics, and other factors, the paper finds millennials who work full-time earn less than boomers and Gen X did. It’s really not a stretch to call this generation overeducated and underpaid.1

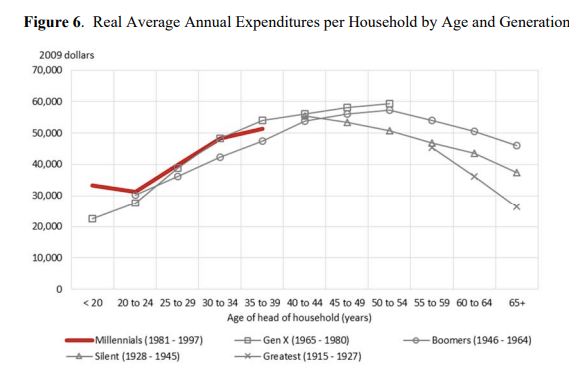

As for spending? Over and over again, the paper shows that millennials really aren’t that remarkable. Looking at our total budgets, millennials consume a little bit more, on average, than baby boomers, and a bit less than Gen X did at this stage of life.

Once they mathematically account for age, income, education, and other characteristics, though, the researchers find “Generation X members and baby boomers actually have a slightly lower taste for consumption than millennials.” In other words, today’s young adults aren’t especially thrifty, given what they make.

That story more or less repeats itself when it comes to specific consumer purchases. Start with cars. Take a look at the paper’s various graphs and tables, and you’ll notice that while millennials may buy a smaller share of all new cars than you’d expect given their demographic size, they have almost the exact same overall vehicle ownership rate as Gen X did at their age (82.6 percent vs. 82.5 percent) and just slightly trail boomers (84.3 percent). In other words, if kids today aren’t buying new cars, they’re at least buying used ones. There doesn’t seem to be much of a cultural turn away from automobiles. And after the researchers toss vehicle spending into their model that accounts for income, demographics, and such, they find no significant difference between generations when it comes to how much they spend each year on their rides.

If you look at the raw consumption data, millennials devote a somewhat bigger share of their budgets to food and housing than previous generations, which might confirm the stereotype of spendy urbanites blowing their budgets on avocado toast. But again, once you throw in all their controls, the differences—while statistically significant—appear to be culturally and economically pretty minor. (Millennials appear predisposed to spend a bit more on their housing than boomers, but almost the same as Gen X.)

All of these results do need to come with a caveat: The Fed paper is based on data that tracks households, not individuals. As a result, it doesn’t necessarily tell us anything about the historically high percentage of young adults who currently live at home with their parents. Some of them may be thrifty 25-year-olds living in their old bedrooms while trying to save money for a down payment. Some of them might just not make enough to move out. It’s hard to say how their inclusion would change the paper’s results.

Still, what the Fed paper amounts to is a pretty persuasive argument that millennials are not penny pinchers or born pedestrians. Instead, they’ve faced a difficult job market early in their careers and a wildly unaffordable housing market, which leaves them to spend as much on rent as past generations did on a mortgage payment. They are, in fact, the brokest generation.

The thing is, I think most of the world has already figured that out. Personally, I’ve been walking back parts of my old Atlantic article for years. (I tried to salvage the cars bit for a while, but to no avail. Millennials clearly like cars.) The new wave of enraging trend stories and marketing guru pronouncements is less about how millennial cultural preferences are reshaping the basic fabric of American life, and more about how they’re just abandoning old consumer brands that haven’t kept up with the times.

Some of these have a patina of plausibility. The CEO of Buffalo Wild Wings says millennials are killing his sales because they supposedly like buying food off Seamless or cooking at home. Some of them are patently absurd: A marketing exec at StarKist suggested tinned tuna was in trouble because lazy millennials think it’s inconvenient. “A lot of millennials don’t even own can openers,” he said. These stories are less about the kind of broad consumption patterns the Fed looks at, or spending preferences, and more about brand preferences. As interesting as it is, this new paper really says nothing about whether millennials are hurting brick-and-mortar retail because they prefer ordering on Amazon, or are about to do in Applebee’s. It does not, sadly, demolish the can-opener theory.

So journalists and car companies will probably have to stop blaming young adult quirks for murdering vehicle sales. But plenty of CEOs in other industries are still free to keep scapegoating us. The cascade of millennial trend pieces will continue on, at least until it’s Gen Z’s turn to be tormented.

1 For those interested in the details: Based on the Panel Study of Income Dynamics, the Fed concludes that young male-headed households earn less on average than in past generations, while female-headed households and married couples earn more, likely due to rising education attainment among women and the rise of dual earner couples. At the median, however, both male- and female-headed households earn less than previous generations, and Millennial couples trail boomers. The difference between medians and averages reflects rising income inequality.